Table of Contents

ToggleTable of Contents

- Rental Yields: Kilimani Apartments

- Rental Yields: Lavington Villas

- Capital Appreciation Trends

- Market Risks and Challenges

- Investor Profiles: Who Should Buy Where?

- FAQs

- Conclusion

Introduction

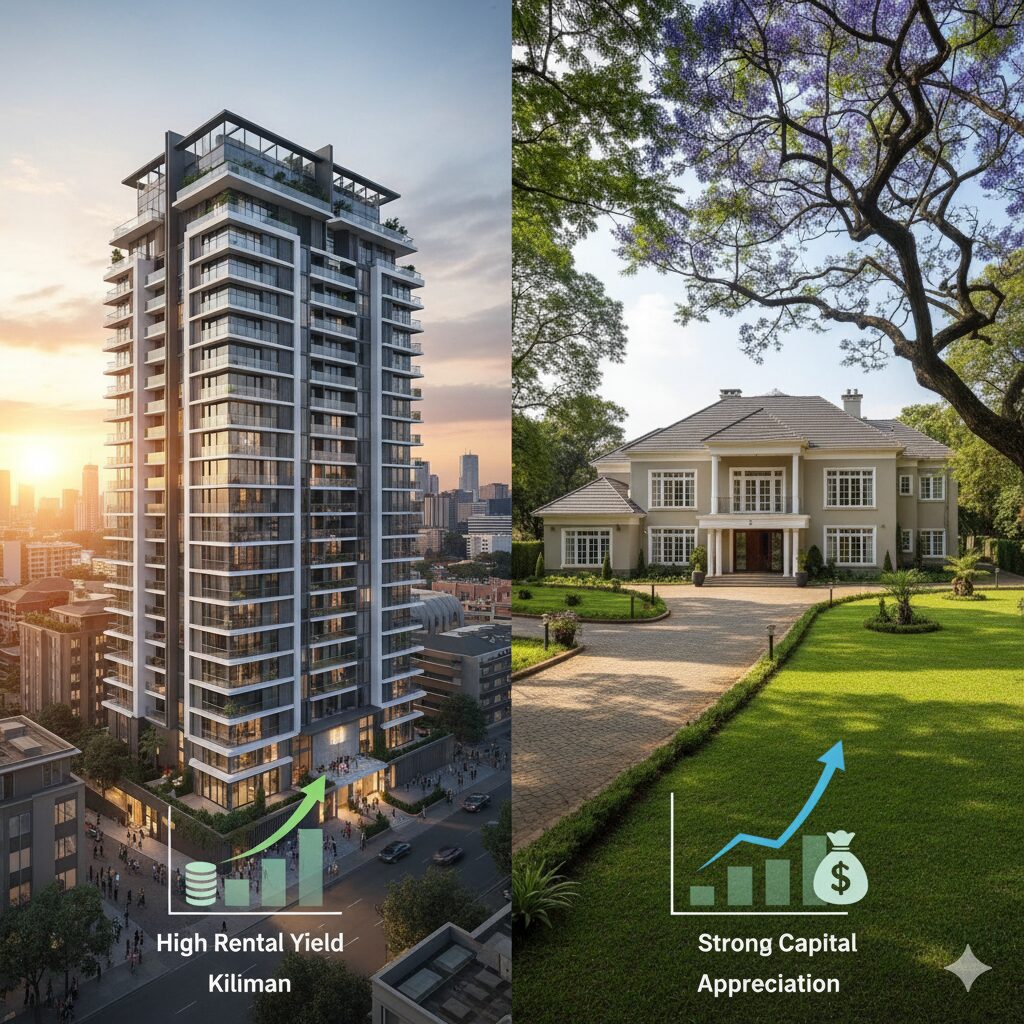

When it comes to real estate investments in Nairobi, Kilimani apartments and Lavington villas are two of the most talked-about options. Both neighborhoods are prestigious, centrally located, and highly sought after by investors and residents. But if your goal is maximizing return on investment (ROI), which one should you choose?

Kilimani is known for its high-rise apartments, buzzing urban lifestyle, and steady demand from young professionals and expatriates. On the other hand, Lavington offers serene, leafy villas and gated communities that attract families and high-net-worth individuals. The type of property you choose will directly affect your rental income, capital appreciation, and long-term profitability.

In this blog, we’ll break down ROI in Kilimani apartments versus Lavington villas, looking at rental yields, appreciation trends, market risks, and investor strategies.

Rental Yields: Kilimani Apartments

Kilimani is a rental hotspot due to its proximity to Nairobi CBD, Westlands, and key institutions. Apartments here generate strong rental income:

- 1–2 bedroom apartments: Ksh 70,000–120,000/month.

- 3-bedroom apartments: Ksh 150,000–250,000/month.

- Average gross rental yield: 6–8%, among the highest in Nairobi.

👉 According to HassConsult’s property index, Kilimani has consistently maintained competitive yields, making it attractive for investors seeking short-term rental returns.

Rental Yields: Lavington Villas

Lavington villas are targeted at a more niche audience: affluent families, diplomats, and long-term renters. Rental figures are higher, but yields are often lower compared to Kilimani.

- 4–5 bedroom villas: Ksh 250,000–450,000/month.

- Average gross rental yield: 4–6%, due to higher purchase prices.

While the yields are lower, villas in gated communities provide longer tenant retention and less vacancy risk compared to apartments.

📌 Example: A 5-bedroom villa in Lavington that costs Ksh 90M could rent at Ksh 400,000/month, giving ~5.3% yield.

Capital Appreciation Trends

Both Kilimani and Lavington enjoy steady appreciation, but the drivers differ:

- Kilimani: Appreciation is fueled by urbanization, infrastructure upgrades, and demand from young buyers. However, oversupply of apartments sometimes slows growth. Average annual appreciation: 6–7%.

- Lavington: Villas appreciate due to exclusivity, land scarcity, and consistent demand for large family homes. Average annual appreciation: 7–9%.

👉 Investors looking for long-term capital growth may find Lavington villas more rewarding.

Market Risks and Challenges

Kilimani Apartments

- Oversupply of apartments → price stagnation risk.

- Increasing service charges and maintenance costs.

- Competition from neighboring estates like Kileleshwa.

Lavington Villas

- High entry cost makes liquidity lower.

- Smaller tenant pool compared to apartments.

- Longer time to resale if you want to exit quickly.

Investor Profiles: Who Should Buy Where?

- Kilimani Apartments: Best for short-to-medium term investors seeking rental income, especially Airbnb operators and those targeting professionals.

- Lavington Villas: Best for long-term investors seeking stability, capital growth, and a prestigious portfolio asset.

📌 If your goal is cash flow, Kilimani apartments are the safer bet. If your goal is wealth preservation and growth, Lavington villas edge ahead.

FAQs

Q1: Which has better ROI — Kilimani or Lavington?

Kilimani apartments offer better rental yields, while Lavington villas provide stronger capital appreciation.

Q2: Are Kilimani apartments oversupplied?

Yes, but prime locations near Yaya Centre and Prestige Mall remain in high demand.

Q3: Do Lavington villas appreciate faster than Kilimani apartments?

Generally yes, due to scarcity of land and exclusivity.

Q4: Which is riskier for investors?

Kilimani has oversupply risk; Lavington has liquidity risk. It depends on your goals.

Conclusion

Both Kilimani and Lavington remain Nairobi’s premier investment hotspots, but the ROI profiles differ. Apartments in Kilimani deliver consistent rental returns, making them ideal for cash flow-driven investors. Villas in Lavington, while costly, offer stronger long-term appreciation and prestige.

The best choice depends on your financial capacity and investment goals: cash flow today, or capital growth tomorrow.

Call-to-Action (CTA)

👉 At Realty Boris, we help investors navigate Nairobi’s dynamic property market. Whether you’re eyeing Kilimani’s high-yield apartments or Lavington’s exclusive villas, our expert advisors will guide you toward the smartest investment. Explore our listings today or contact us for a personalized ROI consultation.