The commercial real estate (CRE) sector is in a state of dynamic evolution, driven by shifting market demands, technological advancements, and regulatory changes. As investors and developers navigate this landscape, understanding the latest trends in land acquisition and development is essential for making informed decisions that maximize returns and minimize risks.

Smart Cities and Technology Integration

One of the most significant trends reshaping land acquisition and development in the CRE sector is the rise of smart cities. Urban areas are increasingly integrating technology to enhance efficiency, sustainability, and quality of life. Developers are prioritizing sites that can accommodate smart infrastructure, including IoT devices, smart grids, and high-speed internet connectivity. These elements are becoming non-negotiable for attracting tech-savvy tenants and businesses looking to future-proof their operations.

Sustainability and Green Building Practices

Sustainability is no longer a niche concern but a mainstream priority. The demand for eco-friendly buildings is soaring, prompting developers to seek land that supports green building practices. This includes areas with access to renewable energy sources, water conservation systems, and materials for constructing energy-efficient buildings. LEED (Leadership in Energy and Environmental Design) certification is often a critical consideration, influencing both land selection and the development process.

Mixed-Use Developments

The appeal of mixed-use developments is another notable trend. These projects combine residential, commercial, and recreational spaces, creating vibrant communities that reduce the need for commuting and enhance local economies. Developers are increasingly seeking land parcels that can support such multifaceted projects, often in urban or suburban areas where there is a high demand for integrated living and working environments.

Adaptive Reuse of Existing Structures

As urban space becomes scarcer and more expensive, adaptive reuse of existing structures is gaining traction. This trend involves repurposing old buildings for new commercial uses, such as converting warehouses into office spaces or retail centers. This approach not only preserves historical architecture but also reduces development costs and time. Developers are on the lookout for properties with historical significance or unique architectural features that can be transformed into modern commercial spaces.

Regulatory and Zoning Flexibility

Navigating regulatory and zoning laws is a critical aspect of land acquisition. There is a growing trend toward flexibility in zoning regulations to accommodate new types of development. Municipalities are increasingly open to rezoning applications that align with economic growth objectives, particularly for projects that promise job creation and infrastructure improvements. Developers need to be adept at negotiating these regulations to secure land in desirable locations.

Remote Work and Decentralized Offices

The shift towards remote work, accelerated by the COVID-19 pandemic, has reshaped the demand for commercial real estate. There is a growing trend towards decentralized office spaces, with companies seeking satellite offices in suburban or even rural areas. This decentralization allows businesses to reduce overhead costs and provide employees with flexible working environments. Developers are thus acquiring land in non-traditional business districts, anticipating the continued popularity of remote and hybrid work models.

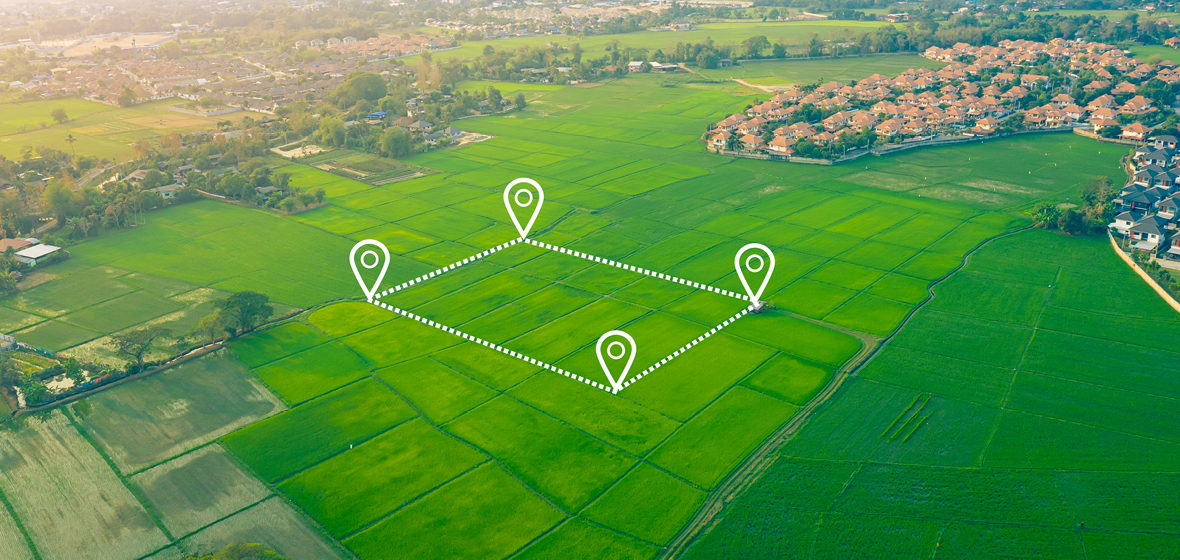

Data-Driven Site Selection

Data analytics is transforming how developers identify and acquire land. Advanced data tools enable comprehensive analysis of potential sites, considering factors such as demographic trends, economic indicators, and local infrastructure. By leveraging big data, developers can make more informed decisions, identifying locations that offer the best potential for growth and profitability.

Public-Private Partnerships

Public-private partnerships (PPPs) are becoming increasingly common in the development of commercial real estate projects. These collaborations can provide access to prime land and funding opportunities while ensuring that developments align with public interests. PPPs are particularly advantageous for large-scale projects, such as transit-oriented developments or urban revitalization efforts. Developers engaging in PPPs often benefit from expedited approval processes and enhanced community support.

Global Investment Trends

The globalization of real estate investment is another key trend. International investors are actively seeking opportunities in diverse markets, driven by the potential for high returns and portfolio diversification. Developers need to be aware of global investment patterns and be prepared to attract foreign capital by offering competitive and strategically located projects. This trend underscores the importance of understanding international market dynamics and fostering relationships with global investors.

Conclusion

The landscape of land acquisition and development in commercial real estate is continually evolving, shaped by technological advancements, sustainability imperatives, and changing work patterns. Developers who stay abreast of these trends and adapt their strategies accordingly will be well-positioned to capitalize on emerging opportunities. By focusing on smart city integration, sustainable practices, mixed-use developments, adaptive reuse, regulatory flexibility, decentralized offices, data-driven decision-making, public-private partnerships, and global investment trends, they can ensure their projects meet the demands of a rapidly changing market.